GOLD PRICE TECHNICAL ANALYSIS

Gold failed to break up the upper bounder in 1360- 70$, we can see very clearly on the charts – trading between 1200-1360+- areas

The big question is when this shuffle trend will finish: will it go to 1400$ Or 1100$?

We have also others facts about US dollar and gold prices such as high yield, interest rates, geopolitical and other factors which could spell out less monetary policy tightening this year.

At this point, the Fed may still raise rates in March, but if we get bad data along this year, which is can be very likely, the market may revise its rate hike expectations

on the other hand is the inflation: Inflation is sneaking up.

Due to the rise in commodity prices (especially oil), a surge in manufacturing activity, and rising GDP in the US and around the world, investors are bracing for higher inflation than what they expected just one month earlier (, the tax cuts, wage increases, and recently imposed trade tariffs are also all inflationary.) many analysts now expect higher inflation this year

there is an interesting study that examined gold’s performance during periods of low inflation (3% or less) vs. high inflation (over 3%). The results confirmed what many of us instinctively knew.

The data over the past 47 years is clear: Gold rises more when inflation is higher than when it is lower, So if inflation heats up this year, history says the gold price will move higher.

If inflation becomes a new reality, it could easily start the next major bull market in gold.

|

| gold analysis |

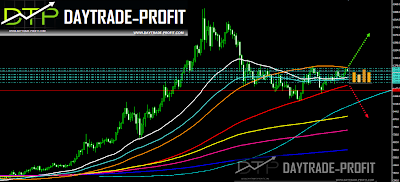

Gold price technical analysis view :

As long as gold xau/usd stay and trade below 1374+_ the trend became bearish, but as long as the gold remains above 1291, I’m expecting to meet 1347 1333 1326 1315 areas – break down 1291 level will lead the gold go to 1247-1256, while we need to watch at 1268-1274 area.

Also, there is the price band is imprisoned between 1170 and 1370 Strong support: 1224-1233 price areas are meaningful numbers

Gold price pattern analysis view :

I want to show you something interesting on the charts is the Bearish Gartley – The main rules of the Bullish and Bearish Gartley are as follows:

• AB must retrace 61.8% of the XA leg

• BC can retrace between 38.2% – 88.6% of AB

• CD can be an extension of 1.272% – 1.618% of AB

• CD can also be a retracement of up to 78.6% of XA leg

you can see this in the long time frame in gold behavior

This pattern suggest that we have an option to see 1530-1560 $ price Ares on gold – what’s more interest is the that the range is equal to this target pattern because 1360-1190 = 170 $ and this also the target for the pattern – break above 1360 will be achieved the same target

|

| gold forecast |

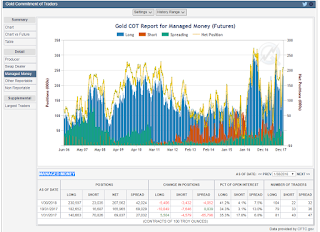

The last thing is COT position, Gold position map :

|

| gold position |

This review does not including any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice