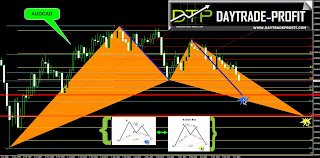

AUDCAD breaks long standing support

Several things about the trend of the AUDCAD cross

You can see that in recent years we have witnessed, with two major correlations, sufficient identity both major pairs, related, commodity prices significantly, and they are:

Australian dollar, versus the gold price

Canadian dollar, versus the price of oil

When correlation is : when the price of goods goes down, so does the performance of currencies.

At this time, we anticipate both, weaker oil during 2014, while the Canadian dollar’s performance in accordance with .see also about gold prices, which began falls, etc. Earlier, in 2012, depending on the price of the Australian dollar.

Last week, we can see the audcad , broken support, located at the level of 0.9370 + _ from 2012.

Technically, you can see that there is a probability of more than 70% following a decline that could reach a level of 0.87 to 0.88, although the level of 0.8130 + –

two pattern can comes to mind: Gartley Pattern or Harmonic Bat Pattern

The strategy now is to sale, placing a stop above the level of refraction

good luck

|

| audcad |

|

| audcad |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice