GOLD ANALYSIS FORECAST

The economic and geopolitical environment looks the primary catalyst moving gold prices higher

Are we facing a ‘black swan event?

In my opinion, we are at a stage when things come out of resetting– markets not coordinated

The trade war between the United States and China

Both presidents of China and the United States supposed to meet at the G-20 meeting at the end of this month in Japan- need to stay focus to see what will be the results

Last week in the Gulf of Oman, two oil tankers were attacked, if it was Iran that made this attack will the United States take military action- if yes What the consequences would be

A massive pile of debt and impossible-to-meet IOUs that the world’s central banks have enabled- nearly $100 trillion increase in global debt since the beginning of the Great Financial Crisis.

This act began in 1971 when the world abandoned the gold standard in favor of the idea that debts themselves could be the backing for debt.

This coming Wednesday the Federal Reserve is expected to announce interest rates. The Federal Reserve is not expected to change interest rates, but the market’s eyes will be directed to the central bank’s forecast for further growth, inflation, and interest rates. It is important to see how many people out of Fed members expect a rate cut this year.

Warning signs that a recession is looking closer, the price of oil is one of them, with oil inventories climbing despite relatively low global oil output prices.

Second is the dramatic inversion of the yield curve, which means a shorter-maturity government is yielding more than longer maturity.

For example, you can get a higher yield on 10-month than 10-year, historically this is an accurate indicator of recession.

despite the economic and geopolitical risks, US markets continue to rise and seem impervious to any bad news – not forever….

This time I will take a risk and say that we are at the stage of entering a period of declines if not in the coming months, then next year if things continue to stay as they are!

Do not be surprised if we will see new highs in the indices, but it will not be in order to continue a long and healthy wave of price in the markets – it will be to clean up weak hands and to repress the truth that appears in the near future.

last year in august and this January I posted :

NOTED FOR THIS: Gold price pattern if 1326 level will hold them we have a potential to see this happen – take a closer look

|

| GOLD forecast |

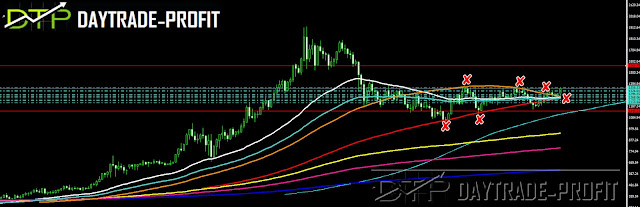

Gold price technical analysis

As long as gold xau/usd stay and trade below 1320+_ the trend is bearish and those targets are on the desk: 1289 1276 1264 1240 1233 1224 1211

If gold remains above 1320, I’m expecting to meet 1347 1333 1326 1315 areas -there is the price band is imprisoned between 1207 and 1347

Gold needs to cross 1378+_ points to confirm upper targets and positive momentum

After those areas, the next resistance levels stay in 1430 1480 and even above 1500: 1530 1560

|

| Gold analysis |

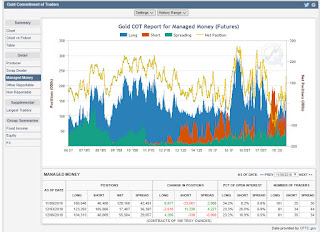

we can see at CME Cot report that there is more room for a big move: take look at the spreading and position, I expect to see a strong decline /decrease in the position before the trend will change, till then the trend is remaining negative as long gold prices remain below 1370+- price, but in MANAGED MONEY section we see an increase in long position so time will tell

|

| GOLD position |

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice