Stock Market Technical Analysis Forecast

This move was expected- Since last records on markets (in end of January), and the beginning of corrections in February the price looks like searching for balanced and direction – the last post was talked about patterns who suggest for more moves

Some economic Facts: The Fed’s balance sheet “narrowed by $ 5.5 billion last week, and the correlation between the Fed’s balance sheet behavior” and market behavior continued this week. The central bank is expected to cut $ 17-20 billion in its balance sheet, which is expected to add enormous pressure on the markets starting next Monday, the main date of the Fed’s tightening of the balance sheet “usually takes place on the 26th, trade war just started but meanwhile china’s reaction to Trump’s tariffs are mild

|

| markets forecast |

The indices have indeed corrected well and now a majority reach critical test levels if the assumption of two trading patterns that can be formed will be implemented then interesting and beautiful movements can be expected

I will refer to the Dow Jones index which reached the aforementioned averages, and now there are two possibilities:

The first option is to continue drop to the area 23,100-23,300 + and from there exit to an ascending process –pay attention to last rally (started at October 2016) I deliberately put the Fibonacci levels on the charts A 38.2%-61.8% retracement is the minimum requirement for a pullback – you can see that the best correction level for the last rally in the markets is in the area 23,200 + _ points

A second option, which is much weightier in terms of its implications, is that the index will not hold the subsidies, and will drop to 21,480, a move that embodies entry into negative territories and doubts the continuation of the story of a rising market

The indices made pullbacks after reaching high side as was written here, you can see the price belt support in the blue color crosses – as long the prices remain above it will confirm for more bullish to come

|

| markets analysis |

The indices made pullbacks after reach high side as was written here, you can see the price belt support in the blue color crosses – as long the prices remain above it will confirm for more bullish to come

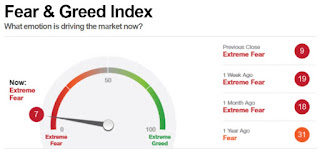

one last thing is the fear greed factor: Currently, the markets are very volatile and nervous, Sentiment markets is extremely pessimistic – CNN Money’s Fear and Greed Index combines 7 indicators to create a sentiment index for the stock market

|

| fear gread factor |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice