An analysis of the upward trend in stock exchanges in recent years

Last week we saw some movements in the markets, will those corrections continue, or it is just a little break before new records

|

| markets forecast |

This week the markets will be at low gear at the beginning of the week because there is holiday in us Independence Day 03-04/07/2017, but after that, we should expect some major moves in the markets

On Friday Nonfarm Payrolls will publish – forecast are + 175K Change in the number of employed

Markets are increasingly betting against the Fed’s willingness to tighten. A flattening yield curve has many economists concerned about a potential Fed policy ‘mistake’ that could lead to a recession. The Fed says it will hike once more this year but with the spread between 2-year and longer maturity paper collapsing many are worried the Fed is tightening too quickly. The spread between the 2-year and 10-year notes has shrunk to its lowest since last August’s nine-year low.

G20 Meetings

Geopolitics and macroeconomic trends will be among the talking points as world leaders gather for the G20 meetings in Hamburg, which kick off on Friday. Issues such as climate change, free trade, and migration will feature heavily.

PMIs

The start of the month sees the usual deluge of purchasing managers’ indices (PMIs), which will complete the picture for Q2 growth in the major economies. Manufacturing surveys are out on Monday with service sector reports on Wednesday.

Canada rates

A batch of economic data from Canada will be closely followed by forex markets as traders raise their expectations for a rate rise this summer. More hawkish comments from Bank of Canada governor Stephen Poloz has upped the chances the central bank will pull the trigger at its July meeting. The Bank of Canada is due to decide on the policy on July 12th.

Australia RBA

Reserve Bank of Australia (RBA) interest rate decision on Tuesday. With potentially thin liquidity stemming from the US Independence Day holiday, Even though the central bank is widely anticipated to hold rates at this meeting, there are signs policymakers are eyeing an imminent path towards normalization. The RBA has forecast inflation returning to target and economic growth to surge to 3% as the global economy picks up. Former board member John Edwards recently weighed into the debate by suggesting the bank could raise rates as many as eight times in the next two years.

Technical analysis:

|

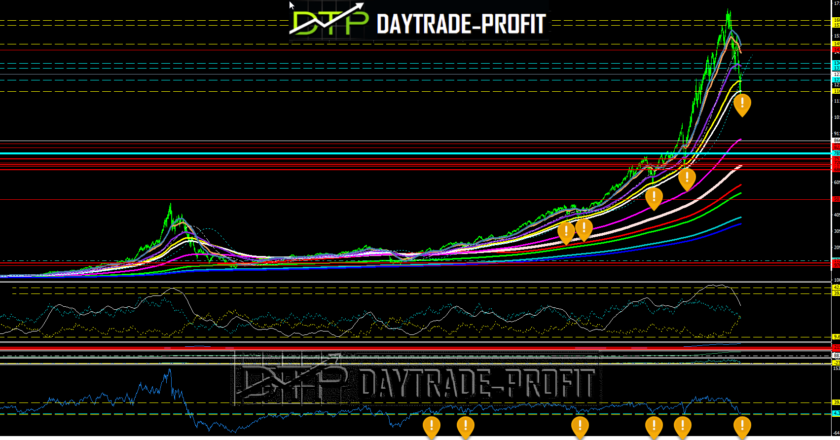

| NASDAQ 100 ANALYSIS |

I expect that stock indexes around the world will go to close the last price gaps created, this time ill focused on the Nasdaq 100 – open gap on 5430-5480 price levels (last April)

The index produces negative deviations since the last record level in the region of 5,900 points, If the deviations are indeed caught, then the closing of the Gap should be expected and even a drop to lower areas of 5320-5400 pts- marked on the charts

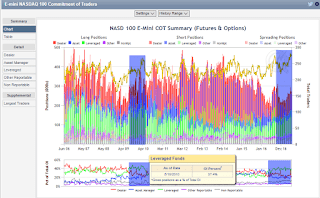

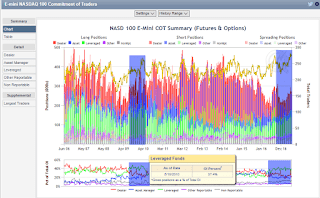

last thing is Commitments of Traders (COT): saw there a similar pattern who took place in April -may 2010, if this is similar so we should expect for some more corrections

|

| Commitments of Traders |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

www.daytrade-profit.com