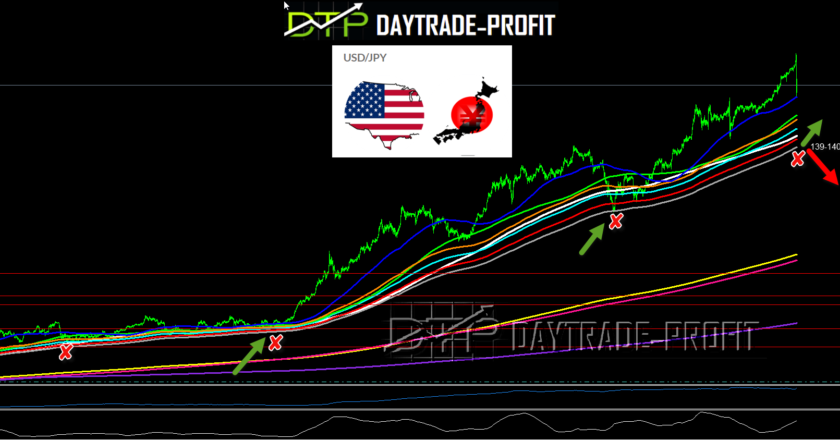

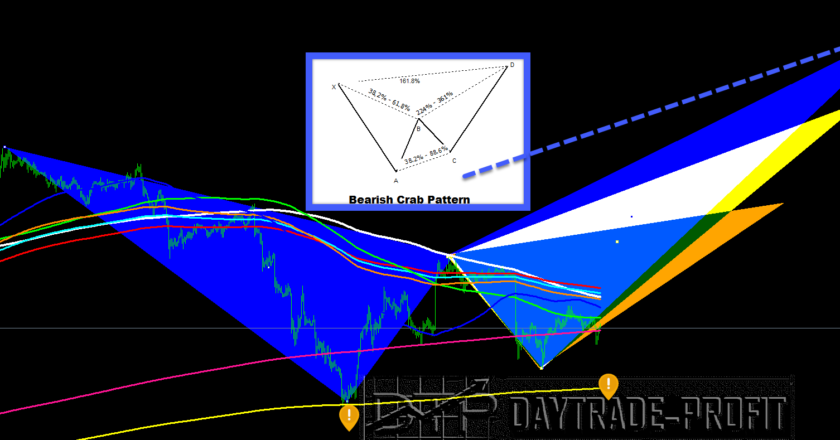

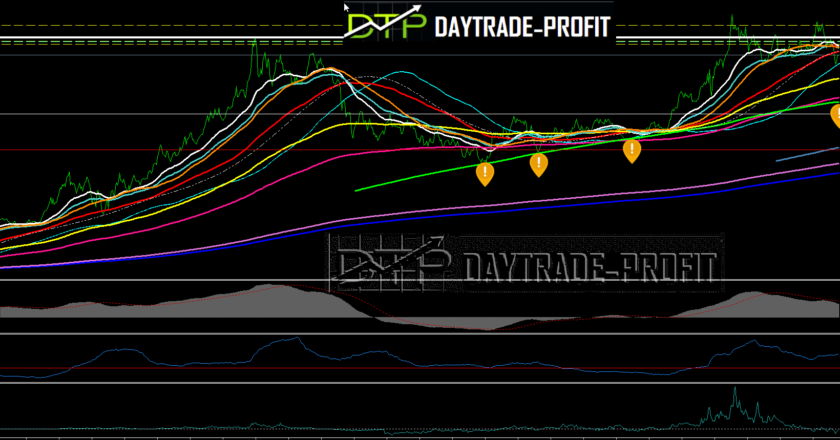

USD/JPY Technical analysis last intervention from Japan was on Friday 21.10.22 after USD/JPY tested 152.00 to the upside before ultimately moving to lows of 146.23 in a quick, aggressive manner – price action that is indicative of official intervention. There are some reasons for JPY weakness besides US dollar’s strength 1. The Japanese household sector Tended to be more interested…