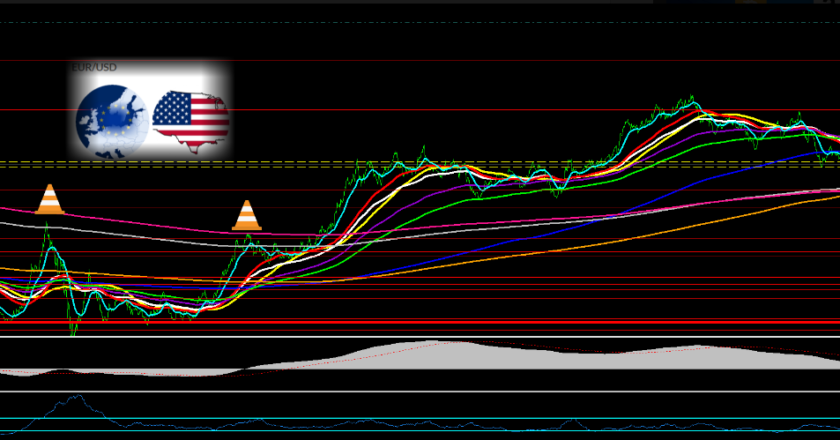

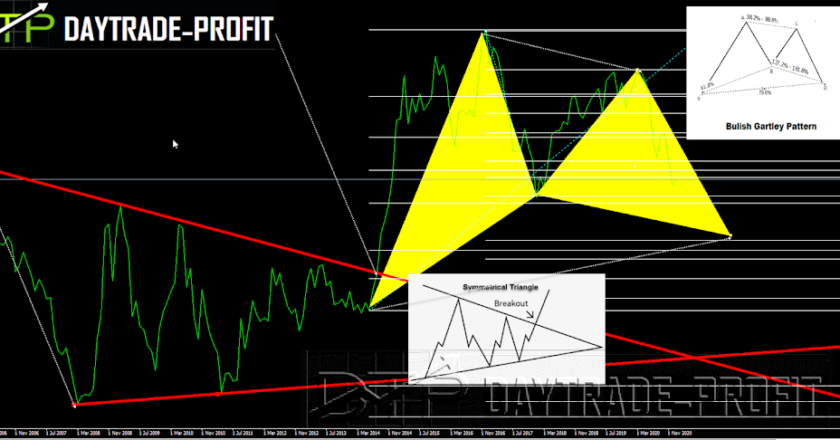

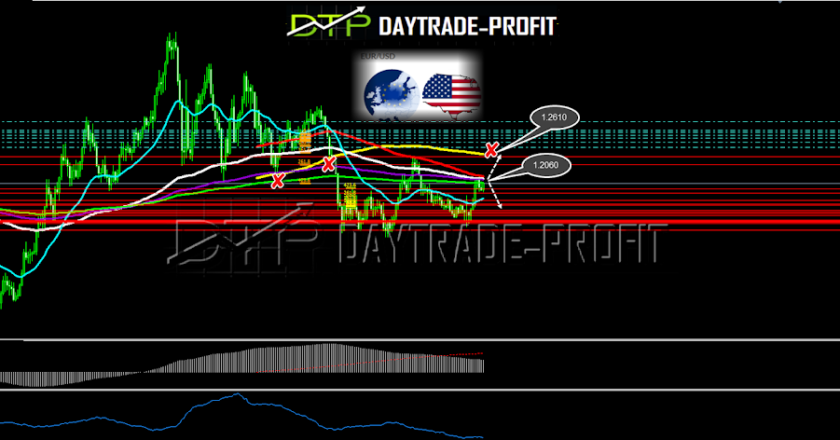

Forex Technical Analysis The U.S. Dollar recover big time against a basket of major currencies as pessimistic increased demand for risk assets and by chance to increase rates in 2022-2023The US dollar index measures the performance of the dollar against a basket of global currenciesUS dollar index (DXY) recover from 30-month low trading at $89.40, and trade now at 92.30$Since…