Harmonic trading pattern

you can identify and see big moves in the market – especially when it comes to the Forex market, Sometimes it seems grandiose and obviously unlikely to come up with a setup like this that gives big and rewarding moves but this can comes, and come in big.

My history trading have caught on some big moves that have taken place in the Forex market

The jpy pairings in 2013

And the Canadian dollar

Do we also have something big in front of us here, with a large Potential movement?

According to the technical analysis and harmonic patterns, it seems so!

Good technical eyes, patient, stick to the plan and you can earn from the big movement in the markets and make profits

Now I’m talking about the Australian pound: GBP /AUD

|

| GBP AUD analysis |

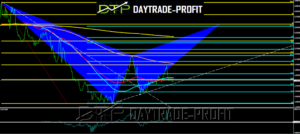

you can see that there is a scenario of 2 harmonic patterns

the first gives a target of 2.30-2.40 area which is equivalent to 20% yield

the second gives a target of 2.70-2.80 which is equivalent to a 40% yield

An important thing in such transactions! Because it is across, so the changes are big, there are 2 independent currencies in their behavior – this is not a major (currency versus dollar or euro) so the moves are bigger and more radical

The stop for such a deal is far away – a magnitude of 9%!

This should be taken into consideration when you enter into the trade

It’s not a deal that you checked every day and every hour

now let’s go and see from the technical side what things are supposed to be

I’ll actually start with the “more solid” pattern

good technical eyes, patient, stick to the plan and you can earn from the big movement in the markets and make profits

|

| GBP AUD trading pattern |

Bearish Bat pattern.

AB leg can retrace between 38.2% – 50% of XA leg

BC leg can retrace between 38.2% – 88.6% of AB leg

CD leg can retrace up to 88.6% of XA leg

CD leg can also be an extension of between 1.618% – 2.618% of AB leg

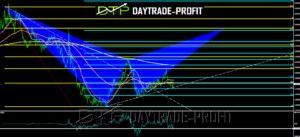

The second harmonic pattern

Bearish Gartley pattern

AB must retrace 61.8% of the XA leg

BC can retrace between 38.2% – 88.6% of AB

CD can be an extension of 1.272% – 1.618% of AB

CD can also be a retrenchment of up to 78.6% of XA leg

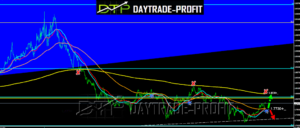

Risk-reward now looks good to enter this trade with support on the lines- see sample

break this down will probably lead the pair to 1.82+

|

| GBP/AUD news |

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice

www.daytrade-profit.com