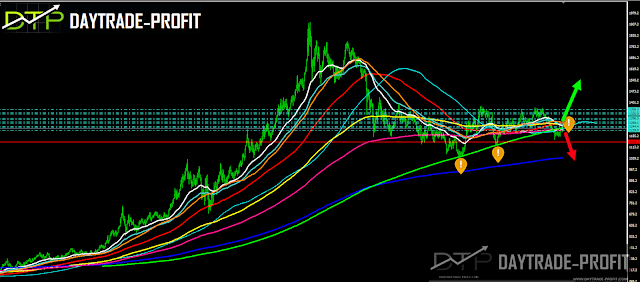

Gold price technical analysis

After Gold has been stuck around the $1,200-an-ounce level for almost 9 weeks he managed to cross for this level for almost last four weeks and traded above 1229 $.

Federal Reserve monetary policy meeting is today- According to analysts, an impending interest rate hike November 07 will keep a lid on any significant gold rally in the near term. Markets are all but guaranteeing an interest-rate hike, Fed federal funds rate now stands at 2.25 percent. That’s up considerably from its near-zero rate during much of Barack Obama’s two terms as president, but it’s still historically low, not yet having reached the long-term average of 4.82 percent.

if geopolitical uncertainty starts to rise in the near term, investors are probably more likely to invest in the U.S. dollar and Treasuries than gold.

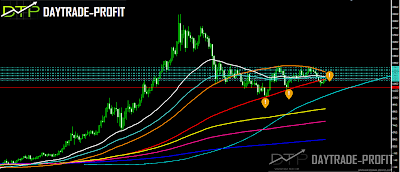

I wrote last time that For approval more optimistic view we need to see prices push above $1,229 an ounce to negate the April downtrend.- you can see clearly that weekly closed didn’t manage to cross above the green strip

|

| GOLD ANALYSIS |

Gold price technical analysis

As long as gold xau/usd stay and trade below 1239+_ the trend is bearish, if the gold will cross up above 1239 I’m expecting to meet 1260 areas

there is major supporting price band imprisoned between 1207 and 1223 Strong support: 1224 & 1211 price areas are meaningful numbers and the big trend support stay in 1207 – but it failed to do that so now correction is more than welcome but…… for my opinion its only correction

Gold closing below $1209 will be sent him to lower numbers the first immediate target could be $1180, $1145, $1045 and then $931.

break down again last lows and especially 1043+_ will send gold to 931 $+-you can see clearly the trend has changed to negative by looking at the charts: looking at the indicator below the blue one – cross down the red line!

|

| gold chart |

This review does not include any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice