Stock Markets Technical analysis

us stock exchanges closed last day as sharp declines as the leading technology index, Nasdaq, plummeted 4.1%, the worst day since June 2016. The Dow Jones Industrial Average fell 3.1%, the sharpest since February and the S & P 500 fell by 3.3%, the sharpest decline since February, and the VIX index, which measures market volatility and also called the “fear index,” jumped 40% to its highest level in several months.

Sharp drops in stock prices are recorded across Asian stock markets, following the sharp falls on Wall Street last night. The panic is spreading among investors after last week’s bond prices also fell, in light of rising interest rates in the US and continuing fears of a trade war that would hurt the global value chain.

|

| Stock Markets analysis |

Market highlights from the beginning of the year :

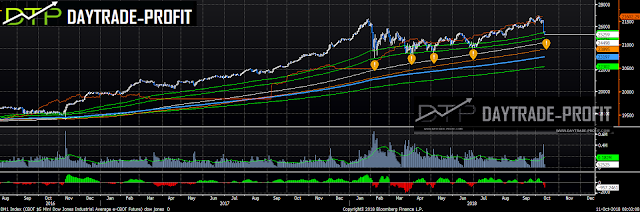

Technical analysis view – focused on the dow jones

One can see the clear convergence, which was one of the declines that began in January an examination of the level of resistance, buyers versus sellers is reflected well on the price graph of the index In my opinion, in May, the beginning of the real recovery can be seen very well. What now? As I said, and from the technical perspective, the level of support can be clearly seen in the previous peak area at the beginning of the year, when I think that the main level lies in the price level of 24,900+- point area – its the key point. The continuation of the move moves towards high price levels and creating new highs

|

| Dow Jones analysis |

|

| NASDAQ chart analysis |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice