The Best Resources For Day Trade – Part 4

The Best Resources For Day Trade Part 1

The Best Resources For Day Trade Part 2

The Best Resources For Day Trade Part 3

Step 1- Choosing a tracking and trading of instruments

Professional trader should be between 9 and 12 instruments monitored. Below that there is not enough diversification and over 12 it is confusing. Instruments to be good at least one from each of the four families: indices, currencies, commodities and interest rates

Requirements to select an instrument:

Trading volume looked into very big idea is that the action of a single body should not affect the market. When the market behaves in the form of a flock, according to Dow theory, it is possible to trade without the worry and feel ‘They’re working on you “or market banded against you. Here you are one small part of an infinite and no one can dictate the behavior and fluctuations in prices and that fair and honest trade

Trading is available easy – in the modern era of high-speed Internet can concentrate on the most popular contracts traded electronically through major exchanges. Your best interest as a trader is to invest the money where the majority of investors and to form a broad market, with- BID and ASK small gaps where there are opportunities for comfortable entry and exit by pressing a button

Once selected the instruments have to learn a bit about them

Hours trading, Size Exposure, Bursa, minimal traffic size, margin, a brief description of the product

Select the Instruments which are interested in receiving information about him

Case and are interested in more details about any contract you can log on to its Exchange Home www.cme.com

|

| day trade instruments |

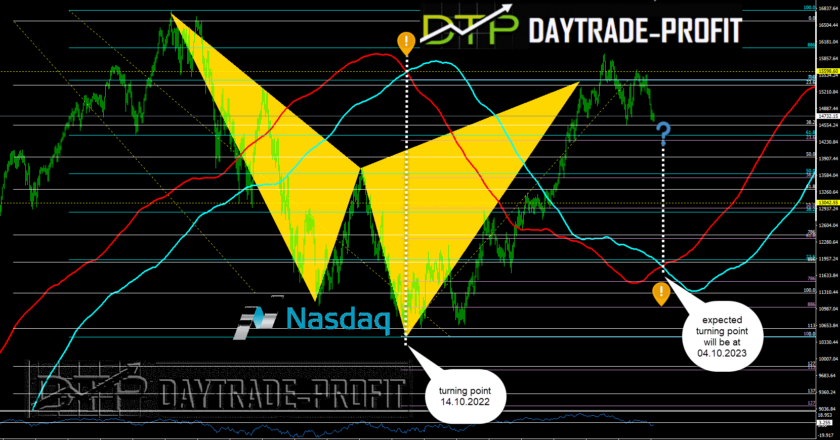

Step 2 -marking support and resistance levels in the long term

Instruments must all wish to trade opening Excel page:

Open graph analysis software historic period of 7 years (not less than two years in order to get a broader picture and not more than 10 years then has been less relevant information). Mark on chart support and resistance levels horizontal (between 5 and 8 lines) and biased (not more than three). The emphasis is on the rapid marking the most obvious level, without lingering on the experience to be accurate or correct. Note that a trend support line marked the lows (where buyers control) biased resistance line marked the peak levels (which bears rule)

After the drawn lines, Shoot the screen (preferably with a button: Print Screen) and copy it to under the photograph has to write the support and resistance levels in numbers

Things to do :

Have to write all the levels marked

As mentioned, there is no need to be precise, but simply write the marked level

These levels will be marked Signal-T

Write even levels that are far from the current price

In the case of a clear long-term trend should be noted in writing. (Increase, decrease or shuffle)

Such a long-term analysis is recommended every three months quarterly)

|

| support and resistance levels |

Step 3- Mark appropriate levels in the medium term trading

Open graph analysis software historic period of three months. Mark on chart support and resistance levels horizontal (4 to 8 lines) and biased (not more than three). The emphasis is on the rapid marking (not more than a minute), the most obvious level, with very short dwell for accuracy

This analysis should be performed every start of the week month

After the drawn lines, Shoot the screen and copy it to the Rose under the long-term chart picture

Under the photograph has to write the support and resistance levels in numbers

Products obtained from analysis of medium-term:

1. Tuning of previous levels – more precise location of the line that marked the long-term chart. This will allow us to more accurately market entry

2. Addition of new levels will be marked with the letter C – these will be more opportunities for trade in the transition to T

3. determining the direction of medium-term trend trading and short: Immigrating trade only Long. Drop – trade only short positions. Shuffle – can be traded in both directions. (Also trading day). Has to try really hard not to trade against the trend that’s always better to be with the majority

4. identifying patterns and there are ongoing case and their description in words (triangles, flags, technical patterns, etc)

5.all add critical level location payable out of the position of Operations.

Daily non-dealer dealer (Day Trader) worked patiently under the trading levels set out with this analysis. Trading is patient because not every day trading opportunities arise, and when an order is perceived there to run it coolly over time without having to be moved daily volatility

|

| day trade planing |

|

| Day trading practice |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice