GOLD PRICE TECHNICAL ANALYSIS

Will the gold continue to surprise in intensity despite the events in the markets.

If we look at a chance risk, and a value against the dollar, then everything we see leads to a golden-favored attitude in this case.

Debt events and banking risks unlike anything we’ve seen since the great crises in history – so the equation leads to precious metals about to enter another stage – and it’s a safe haven

It is likely that the safe-haven assets during the process of a global credit and debt crisis event, plus unlimited quantitative easing by the Fed, will be a refuge against revaluations and loss of dollar value

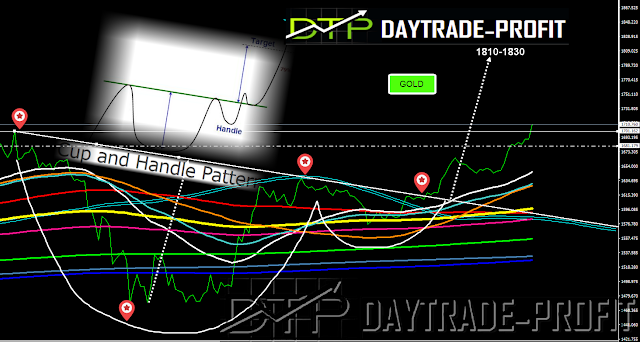

In addition to the technical aspect, you can see the creation of a cap and handle, which also reinforces the hypothesis that the gold price will continue to rise

|

| GOLD ANALYSIS |

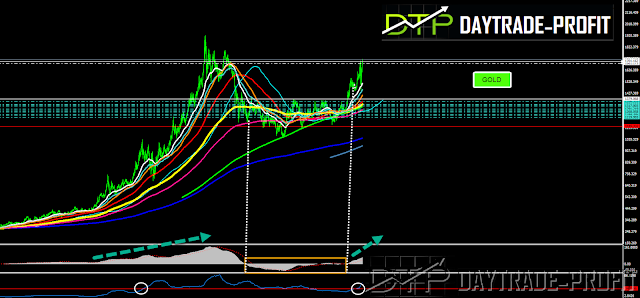

Gold price Technical analysis

As long as gold XAU/USD stays and trade above 1662 the trend is bullish

Next resistance levels stay in 1810-1830

In addition, you can clearly see on a long-term graph, the return to positive territory that occurred in the region of $ 1530

|

| XAU USD ANALYSIS |

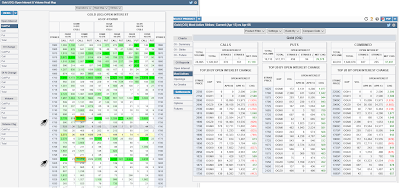

One last thing in the options segment, and the derivatives on the property

You can see intense activity in the higher segments on the 1750 and 1800 strikes

It does not prove that the upper hand is also of the buyers, there may be a situation that made writing in these areas – this figure only for viewing

|

| XAU USD POSITION |

This review does not include any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice

www.daytrade-profit.com