Is USD/JPY price expected to make a comeback

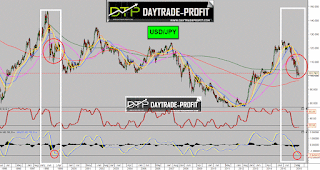

The increase of last week on usdjpy rate , needs to prove itself on several levels.

First last week usdjpy stays below 102.60 a Significant resistance.

Second there is also another Additional resistance zone is in 104.10 price.

Move above 106.20 will Pave the way to 113-115 area.

NON-FARM PAYROLLS AND UNEMPLOYMENT DATA (USA), Friday, September 02 at 12:30 GMT will establish this week, A strong jobs number will confirm a likely rate hike September 21st ,this event is very Significant indicator on the usd/jpy

|

| usd/jpy |

Last post on the usdjpy

http://www.daytrade-profit.com/2016/07/global-markets-turn-to-be-positive-in.html

The BoJ is also arguably close to reaching the limits of its QQE. Credit Agricola CIB’s Japan economist, Kazuhiko Ogata, estimates that at its current rate of asset purchases the BoJ will own over half of the outstanding JGBs by end FY17 and all of the ETFs in about a year. So it is little wonder that the BoJ will be announcing the results of a policy rethink on 21 September, which will be a big event for the JPY, even putting aside any potential action by the FOMC later that same day.

It is worth noting at this point that a tapering of asset purchases by the BoJ would not be a tightening in monetary policy, as the BoJ’s balance sheet would still be expanding, just at a slower pace. Indeed, the BoJ would remain the QE champion amongst major Central Banks . So while the knee-jerk reaction by investors to a decision by the BoJ to taper would be to buy the JPY, we think that in the medium-term, the direction of the JPY will be determined more by the FOMC than the BoJ. History provides examples of the impact on USD/JPY of both BoJ and FOMC tapering of asset purchases. The BoJ undertook a ‘hard tapering’ of its QE when it reduced the size of its balance sheet after pioneering QE in the early 2000s. However, this hard tapering had little impact on USD/JPY as the FOMC was raising interest rates at the same time . So at least part of the BoJ’s decision on 21 September will be impacted by what it thinks the FOMC will do

|

| usd jpy cot |

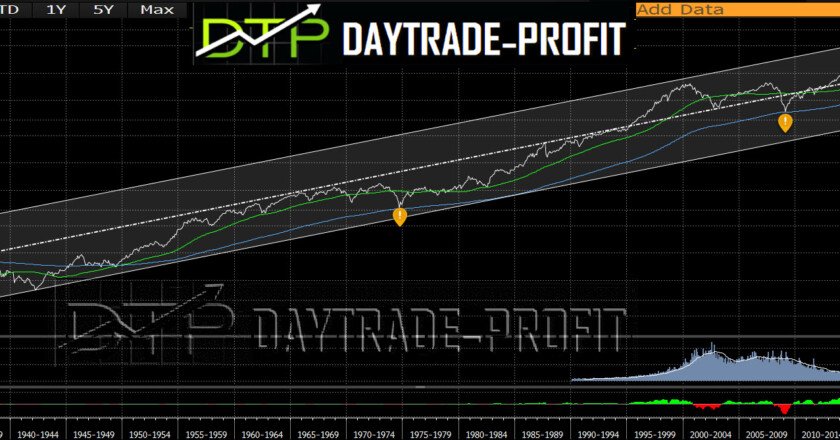

Once again I turn your’s attention to 1998-1999

Note the charts: If the photo is indeed the same, then it is fitting for

Continued increases in the usdjpy, move into a similar facility.

|

| jpy usd |

The Technical side: On the upside, we need to see the pair cross up again 106.20 area, after above 107.20 -109 will revive the case of trend reversal and target TO 112-114 resistance, whıle break down agaın 100.30 area wıl lead the usdjpy to cope with 99-100 area again, furthers more to 98.50 and 96 areas

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice