Markets analysis

long time I didn’t update about the markets ,It’s time to check what’s going on here

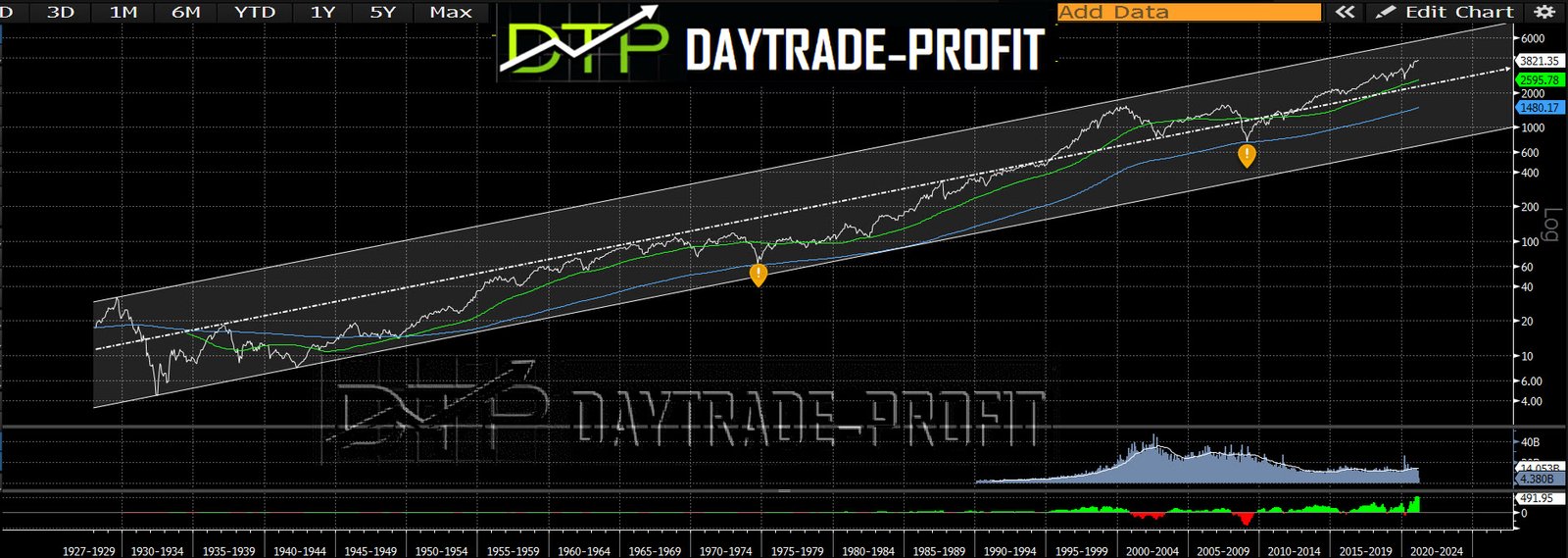

in 2021 i post S&P 500 prediction for the next years

Has the Market Correction Started?

The question of whether a market correction has started is always a topic of interest among investors. However, it’s not always easy to answer. Market corrections are typically identified in hindsight, and their onset can be difficult to pinpoint in real-time.

a significant drop in a single day does not necessarily indicate correction. Instead, it’s crucial to look at trends over a more extended period.

Market correction is an inevitable part of the financial market cycle. It is a phase where the stock market or a particular asset class experiences a significant decline in value, typically by 10% or more from its recent peak. This phenomenon is often viewed negatively, but it is essential to understand that market corrections are a natural part of the market’s ebb and flow.

Market corrections can be triggered by various factors. One of the most common causes is overvaluation. When asset prices rise too quickly and reach unsustainable levels, a correction may occur as investors start to sell off their holdings to realize profits.

Economic indicators can also trigger a market correction. For instance, a sudden increase in inflation, a decrease in consumer confidence, or a slowdown in GDP growth can cause investors to reevaluate their positions, leading to a sell-off.

Geopolitical events, such as wars, elections, or changes in government policy, can also cause market corrections. These events can create uncertainty, leading investors to sell their assets until the situation becomes clearer.

since 2008 – this not has been seen in the market :cot position map show Asset Manager/Institutional short position shows only 10%

(Asset Manager/Institutional. These are institutional investors, including pension funds,

endowments, insurance companies, mutual funds and those portfolio/investment managers

whose clients are predominantly institutional.)

Now lest focus on the S&P 500 :my assumption that correction time arrive

The assumption telling me that yesterday highs in the S&P 500 future price which targets at 5332 points will not break through on a daily closing basis in the next 3-4 trading days

It is possible that there will also be entry at higher price levels again, then there is an option of returning to area 5270 for Joining Short from the higher levels

Technical analysis for the S&P 500:

Short support areas: 5170+

Short resistance areas: 5326 +

Long support areas: 4416+

Long resistance areas: last high for now

An open gap at 4650-4690 points

need to watch 5130- 5160 area last lows – (Correction approved will take place when we will be closed daily below+)

Below those level as mentioned above – targets point stay at 4860-4930 -5030

|

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice