Are we seeing the high for the short-medium period?

Identifying signs of a potential market top can be challenging, as market conditions can vary and indicators may differ across different market cycles. However, here are some general signs that investors and analysts often consider when assessing whether a market may be reaching a top:

Overvaluation: Elevated market valuations, such as high price-to-earnings (P/E) ratios or price-to-sales (P/S) ratios, could indicate that stocks are priced beyond their fundamental value. This could suggest a potential market top.

Divergence: If there is a significant divergence between market indices and other indicators, such as declining trading volumes, weakening breadth (the number of stocks participating in the market rally), or declining market momentum, it could be a sign that the market is losing steam.

Investor Sentiment: Extreme bullish sentiment, as reflected in measures like high levels of optimism, excessive speculation, or a surge in retail investor participation, could indicate a potential market top. This is because markets often experience a period of euphoria before a correction.

Economic Indicators: Weakening economic indicators, such as slowing GDP growth, rising inflation, tightening monetary policy, or deteriorating corporate earnings, may suggest that the market could be approaching the top.

Technical Analysis: Technical indicators, such as trend reversals, bearish chart patterns, or negative divergences in oscillators like the Relative Strength Index (RSI), can provide signals of a potential market top.

Predicting the exact timing of a market correction is challenging, but there are several signs that investors and analysts often consider as potential indicators of an impending correction. These signs can include:

Overextended Bull Market: If the market has been in a prolonged period of upward momentum, with significant gains over an extended period, it could suggest that a correction may be on the horizon.

Elevated Valuations: High valuations, such as elevated price-to-earnings (P/E) ratios or price-to-sales (P/S) ratios, relative to historical averages or industry norms, could indicate that stocks are overvalued and susceptible to a correction.

Deteriorating Economic Indicators: Weakening economic indicators, such as slowing GDP growth, rising unemployment rates, declining consumer spending, or weakening corporate earnings, may signal an economic slowdown and increase the likelihood of a market correction.

A shift in Central Bank Policies: Changes in monetary policy, such as interest rate hikes or tightening liquidity measures, can impact market sentiment and potentially trigger a correction.

Market Sentiment and Speculative Behavior: Excessive optimism, increased speculation, and a general sense of euphoria in the market can be warning signs that a correction may be imminent, as these behaviors can lead to overvaluation and asset bubbles.

Volatility Spikes: A sudden increase in market volatility, as measured by indicators like the VIX (CBOE Volatility Index), can suggest growing uncertainty and the potential for a market correction.

Technical Analysis: Bearish chart patterns, such as lower highs and lower lows, breakdowns of key support levels, or negative divergences in technical indicators, can provide signals of an impending correction.

It’s important to note that these signs are not foolproof indicators, and market timing is difficult. Corrections can be triggered by unexpected events or factors, and markets can sometimes remain irrational for longer than expected.

the last post was: Does the economic situation of the stock market combined with the bond markets reflects the real problem?

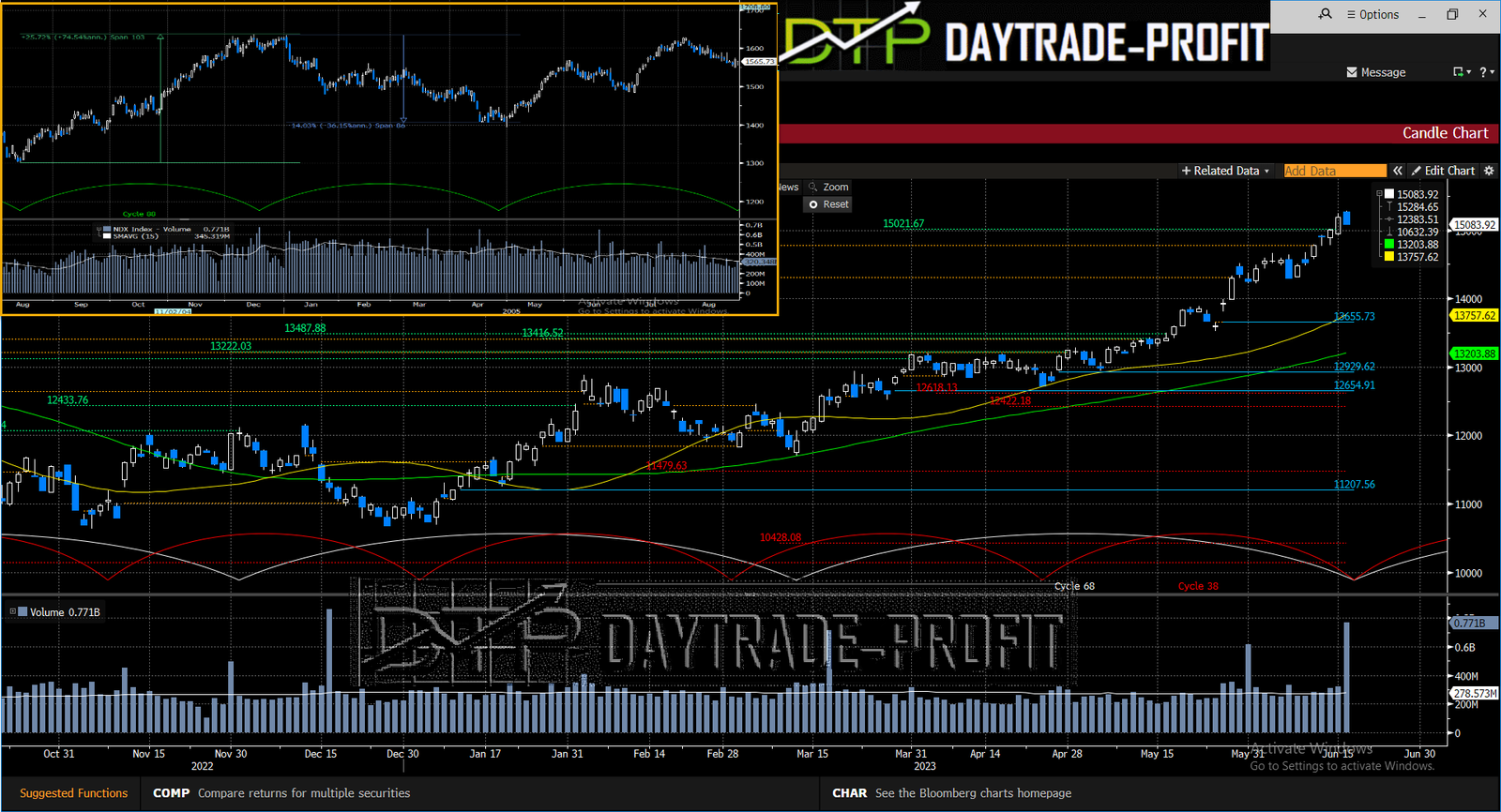

Now let’s test the Nasdaq

I think that the max move can play till 15600+_ if this is the right pattern

Correction approved will take place when we will be closed daily below 14630+_

Short support areas: 14200,13400,12600

The big major support stays at 11600+-

An open gap on 13700-13800

There is a similar scenario that happened in 2004 -time will tell if this scenario will take place in 2023 – if yes so the targets are written above

It is important to note that approval for the short has not yet been received!

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice