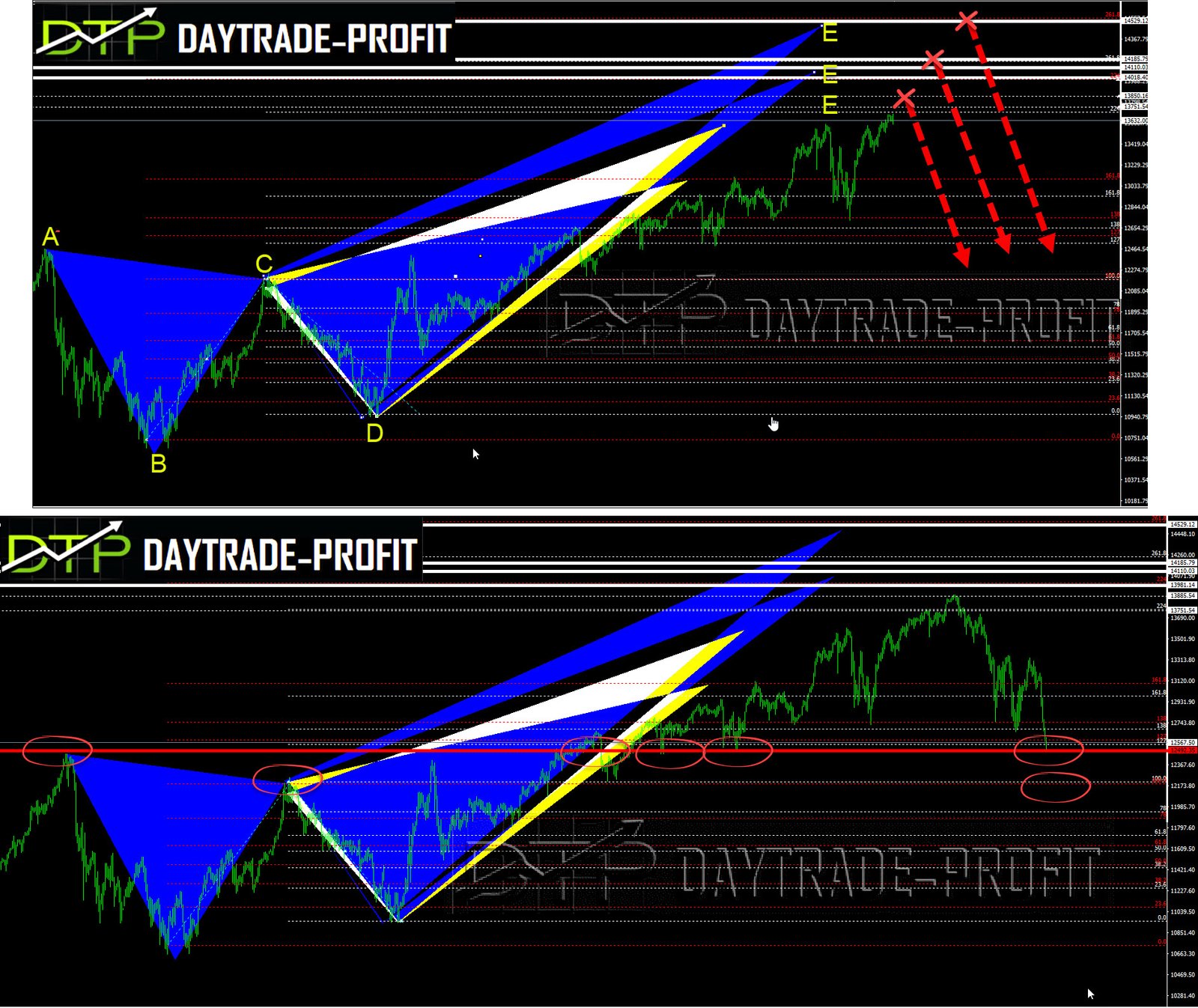

Markets Technical analysis

in 8.2.2021 I published this markets never-ending short squeeze

A test drive has come: NASDAQ 100: Closed below 12480 daily will sign for more downtrend while stay above is appositive sign

Are we facing a wave of exhaustion in the markets, or are we in the midst of a bubble wave?

Throughout my years in trading (more than 20 years), I tend to stick to the technical side of trading, this has proven itself more than once

Technically we are in a kind of bubble without any shadow of a doubt – the markets are in insane euphoria that does not stop, but …. does that justify it?

Covid 19 is gone?

Employment at its peak?

Countries debts at a low?

Corporate profits at their peak?

What I see today when I open charts, is something I have not seen for many years

In November when the Nasdaq was at 11,600 points I was talking about

It seems that we are before breaking records – what should we expect

new highs to areas of 13700- 14200 – 15200 points are on the way?

At the end of December, we re-examined the Nasdaq index again

The sloping picture of the gains on the graphs scares me

I want to show you also one of the biggest stock on the NASDAQ index and its apple stock we can see over their ABCD Bearish pattern – target are 108 or 99 Need to watch closely

one more thing on patterns – diamond pattern in DOW JONES index performed

and for the finale let’s check the SP 500: long trend support stay in 3580+_

SP 500 analysis

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice