Markets Technical Analysis

I haven’t written in a long time

The last post on the markets was in June 2022

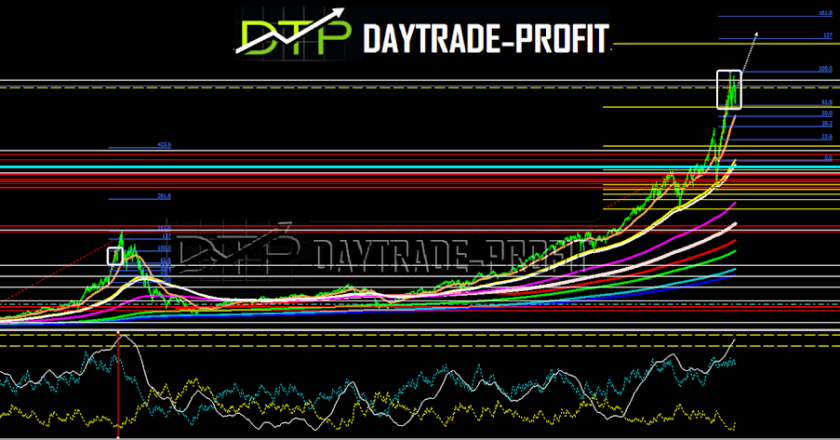

There wasn’t too much to update on the markets, but it seems that we are reaching test levels that will determine whether the declines are over or whether it is just a phase it just a matter of rally January Effect. Everyone is talking about a mild recession everyone thinks the Fed will lower interest rates this year, on the other hand, the actual economy shows negative signs – layoffs, a decrease in consumption, and negative growth – has the awful news become good? Is the consensus clear? Is the stock market ahead of the future or is it in euphoria? Reports of the major ones are ahead of us any questions that have many answers will go to the graphs that tell the story without background noise, and we will technically check what the story is, and where we are will focus on the NASDAQ

NASDAQ:

For the future to come as I said in the last post

Need to see what is happening in the areas of 12800 is critical

If those levels will go above on aweekly basis- the story change!

Also, I mention many times about 11680 points

The major trend in the markets is a negative trend

Minor trend positive as long we stay above 11680

Looking for 12030 to see if we can move up to 12100, 12300-12430,12600 and 12800

Correction at this stage to areas 11680 _ is quite likely for those who looking for a reconnection to extended trade to the levels I mentioned above, alternatively, a decline from area 11600 will confirm that we get back to a downtrend

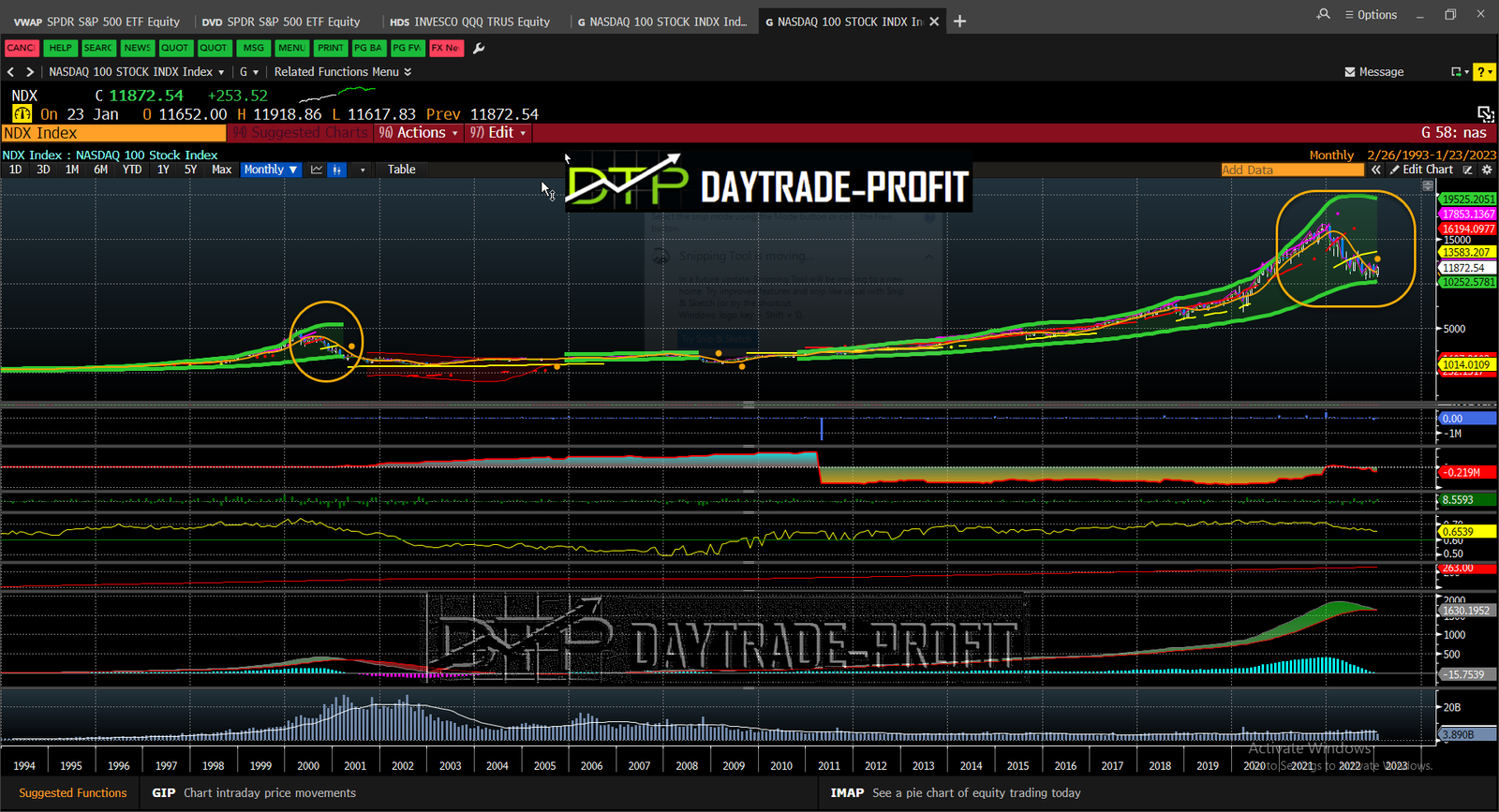

Looking at a long-term graph of the NASDAQ, you can clearly see when it is positive and when it is negative

Green bands (uptrend) and red (downtrend)

It can be noticed that even during the major corrections in 2000-2001, it remained red until 2003

So from this point of view, there is nothing to think that Hook has changed his skin yet – talking about 2023

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice