Technical Markets update

Last post: Has the weakness in the indices faded and returned to a new high

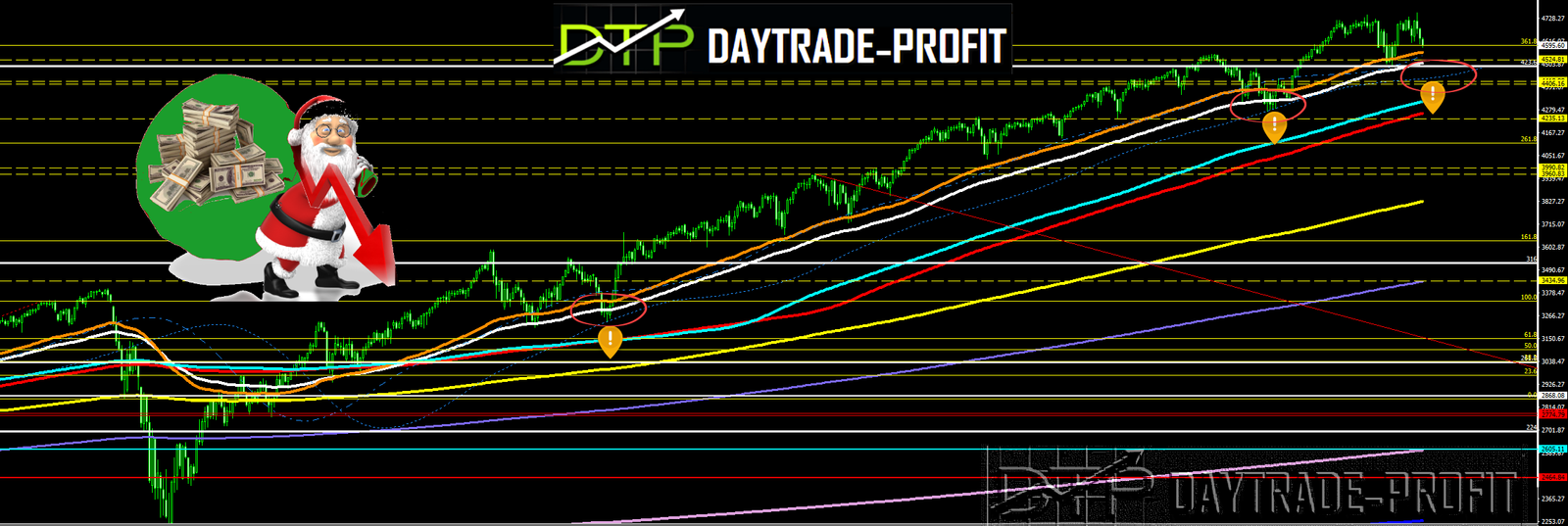

Important price levels

4650

4610

4580 – large impact trader volumes were In this price segment!

4520

Last week there was a lot of volatility – after the big expiration date of square witches options passed

Since June, the days after the expiration of the options have led to significant moves in the S&P 500 The market should be freer to move up or down as gamma levels of options in the decline of the S&P 500

Equities and oil prices dropped on mounting concerns for the global economy, as the rapid spread of the Omicron coronavirus variant prompted governments across Europe to impose restrictions.

COVID pandemic remains uncertain, especially given the latest more contagious though not necessarily more lethal omicron variant.

The Federal Reserve has announced that it is accelerating the reduction in its asset purchases, which are now expected to end in March 2022 instead of June, and Fed policymakers have indicated a preference for three interest rate hikes next year, compared to one or two increases strategists previously expected

Currently as can be seen the markets are fighting for buffer zones 4520-4580, As long as the index is below the 4580-4620 range the trend is negative

Apoint of view in a broader perspective on markets:

The critical equilibrium point since the eruption of the covid19, and the exit to rise in markets in March 2020, is currently in the region of 4430 + – points – breaking down from this area, on a daily basis combined with high volume will not bode well for further, on the other hand, support for this area will Give an option to continue joining to enter a long position to higher levels in the markets

Those are the expectations for next year for raising interest rates

Fed Rate expectation

This review does not include any document and/or file attached to it as advice or recommendation to buy/sell securities and/or other advice