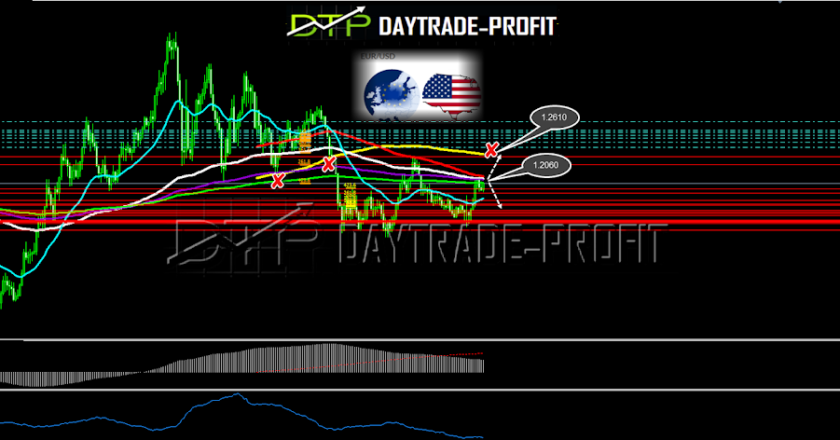

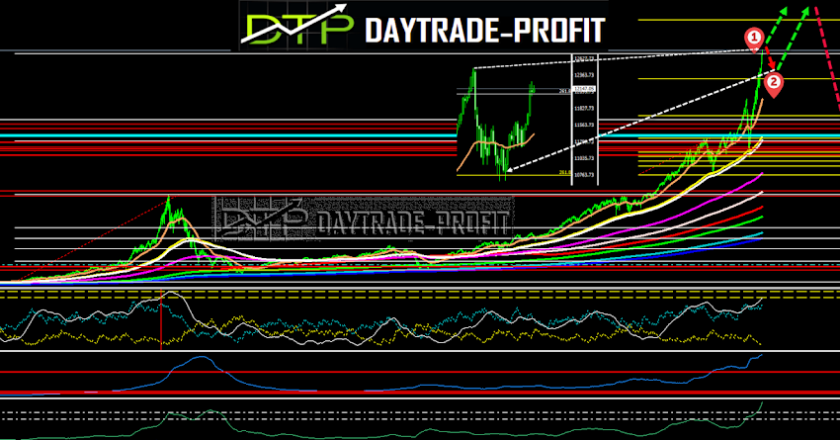

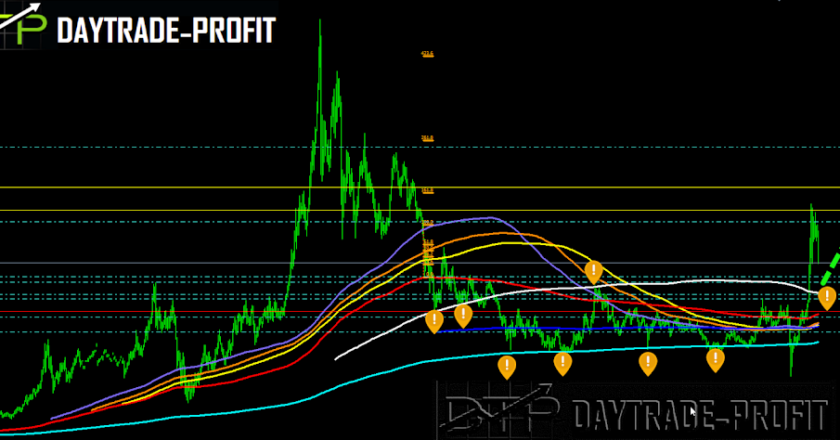

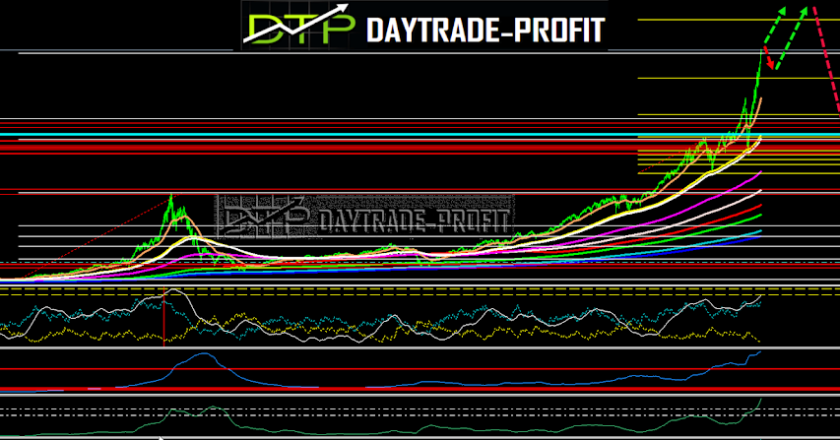

Forex Technical Analysis The U.S. Dollar stays very vulnerable and struggled for lower numbers against a basket of major currencies As optimism increased demand for risk assets and by a positive movement toward a coronavirus vaccine US dollar index (DXY) close to dropped to 30-month low trading at $91.10, which is close to its lowest level since May 2018. The US…