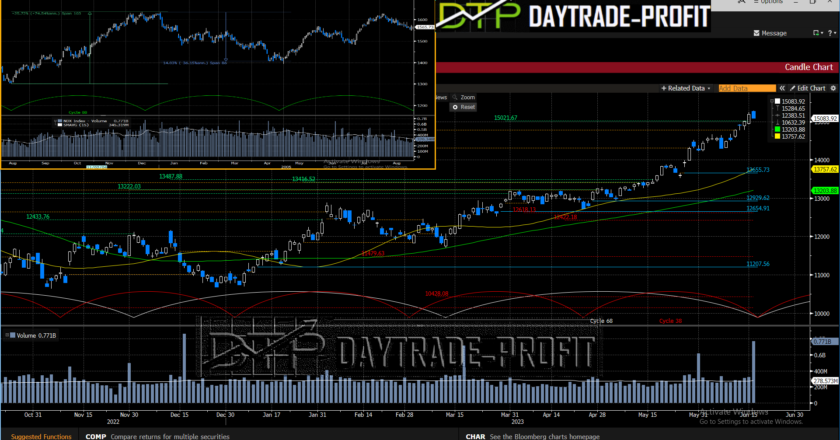

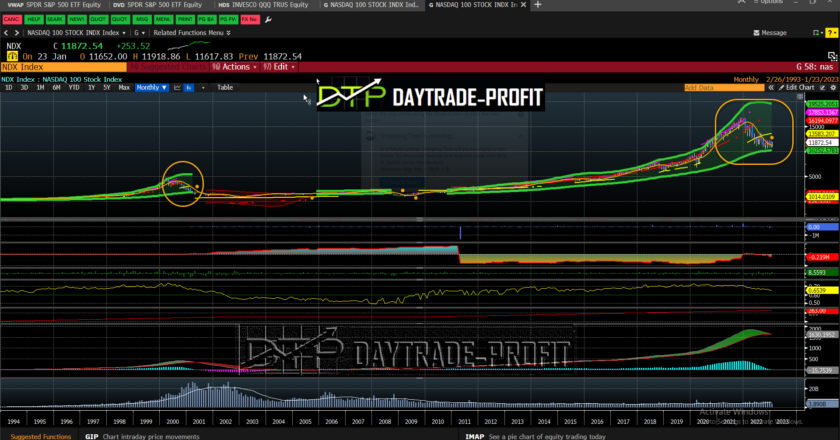

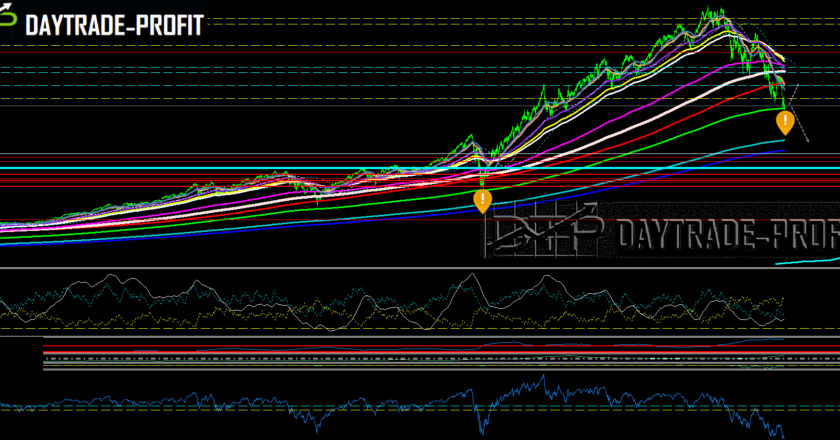

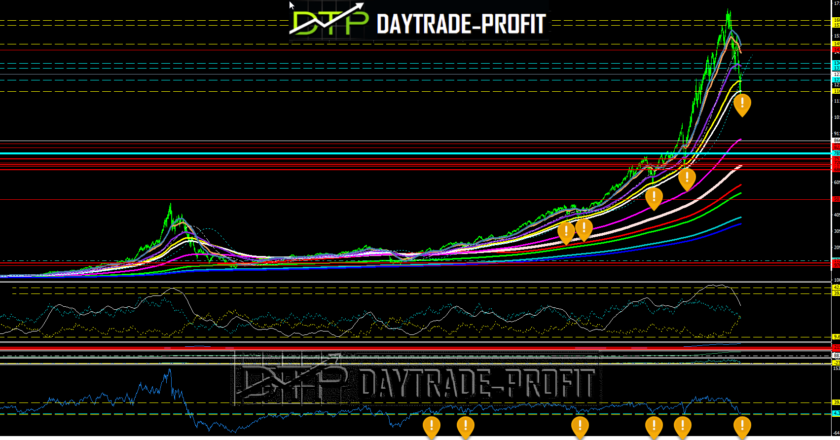

Are we seeing the high for the short-medium period? Identifying signs of a potential market top can be challenging, as market conditions can vary and indicators may differ across different market cycles. However, here are some general signs that investors and analysts often consider when assessing whether a market may be reaching a top: Overvaluation: Elevated market valuations, such as…