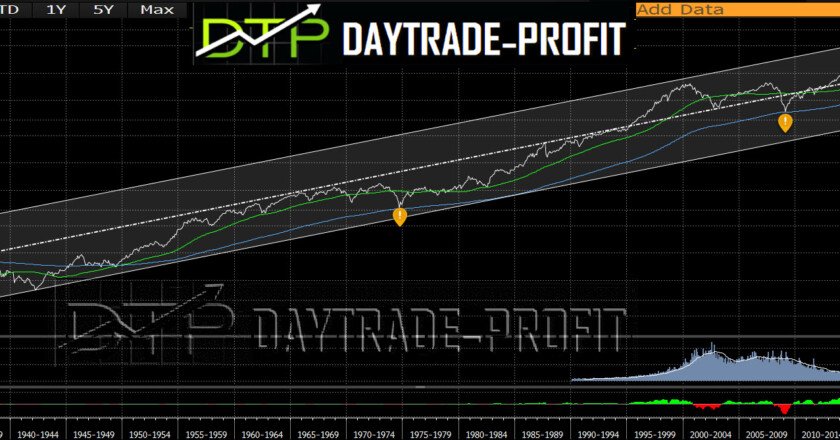

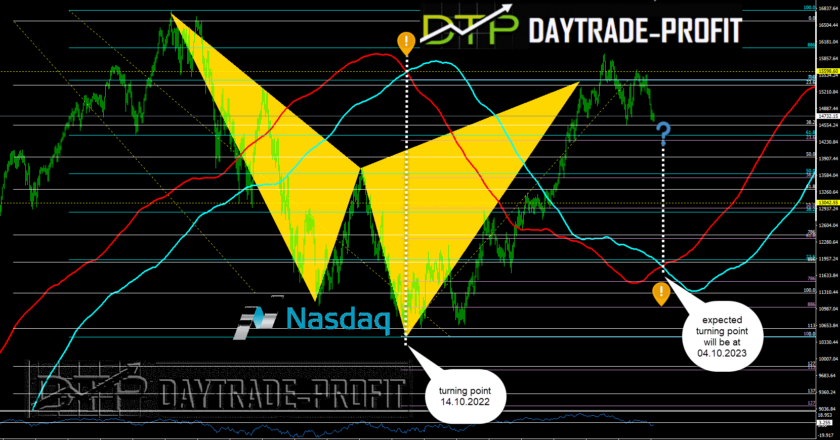

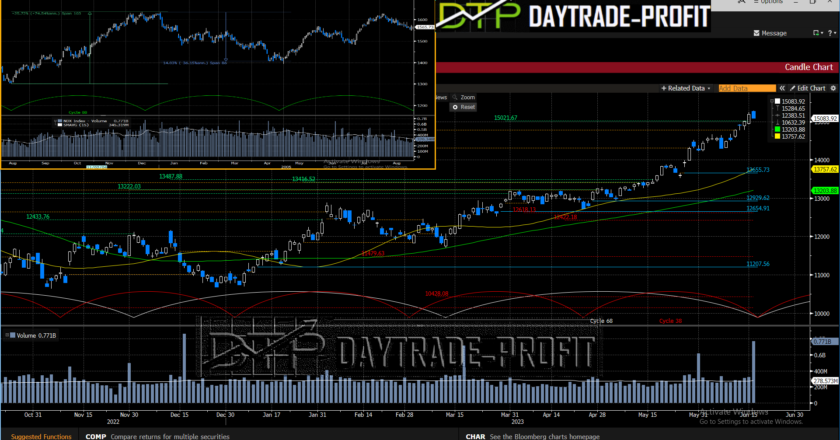

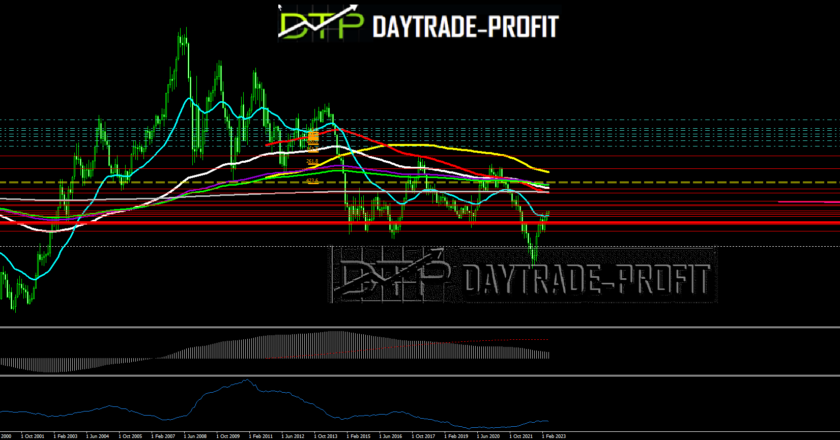

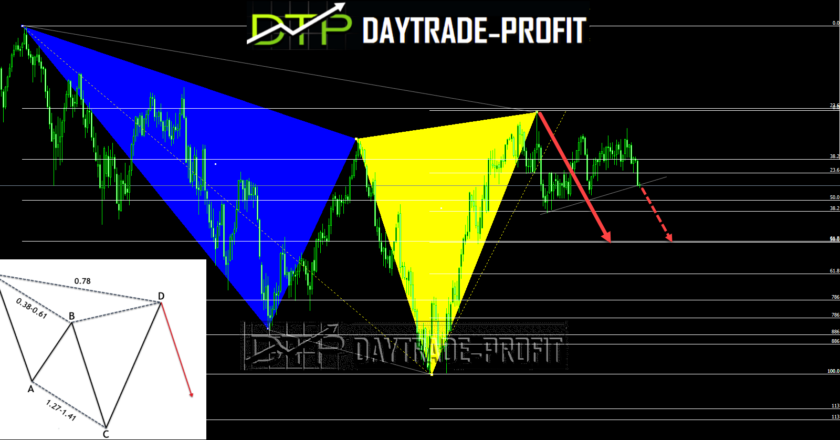

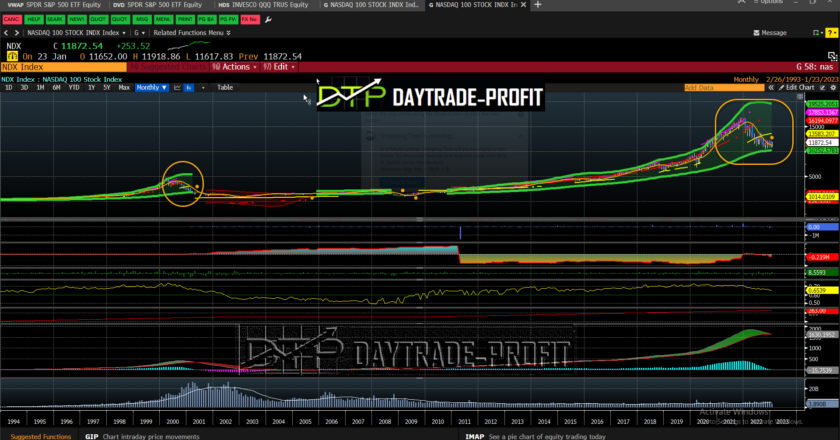

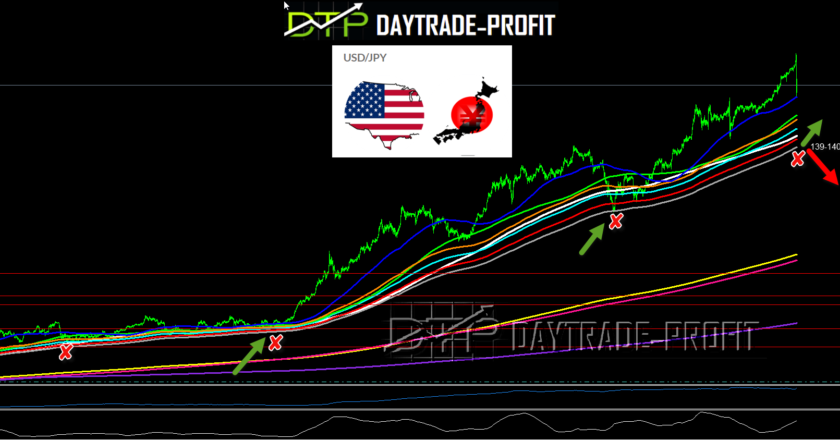

Markets analysis long time I didn’t update about the markets ,It’s time to check what’s going on here in 2021 i post S&P 500 prediction for the next years Has the Market Correction Started? The question of whether a market correction has started is always a topic of interest among investors. However, it’s not always easy to answer. Market corrections are typically…