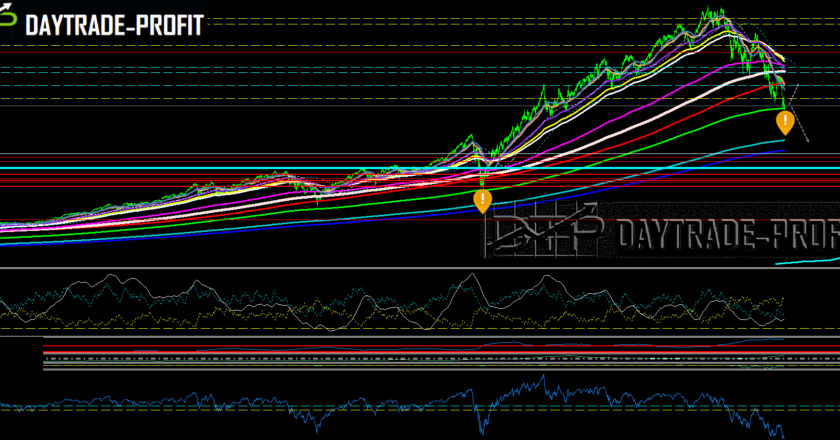

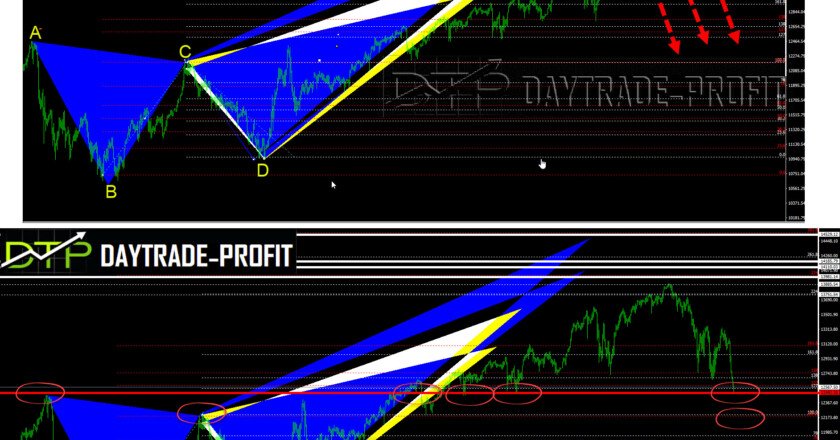

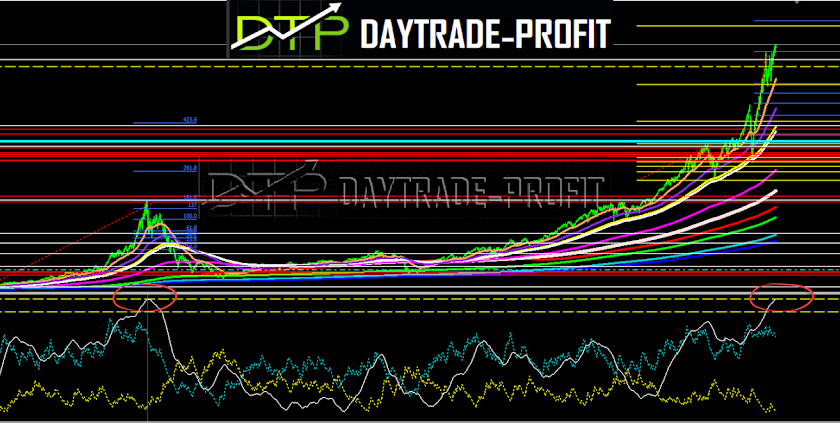

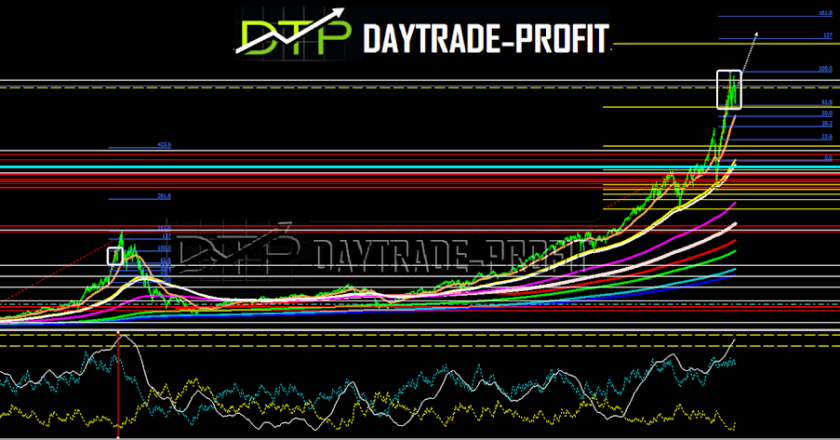

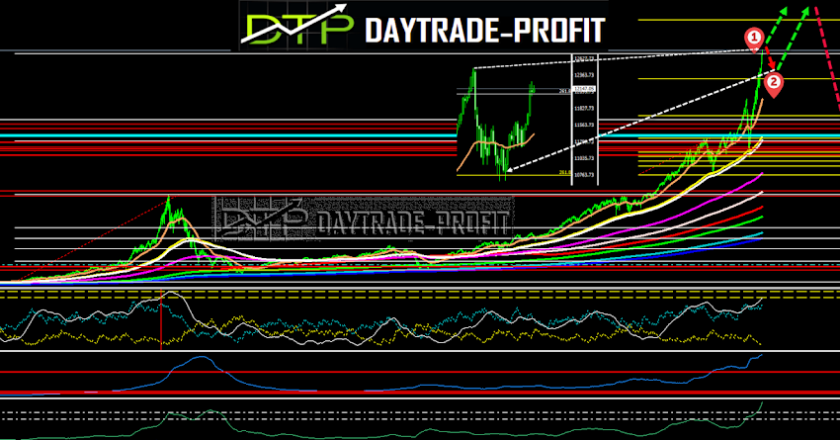

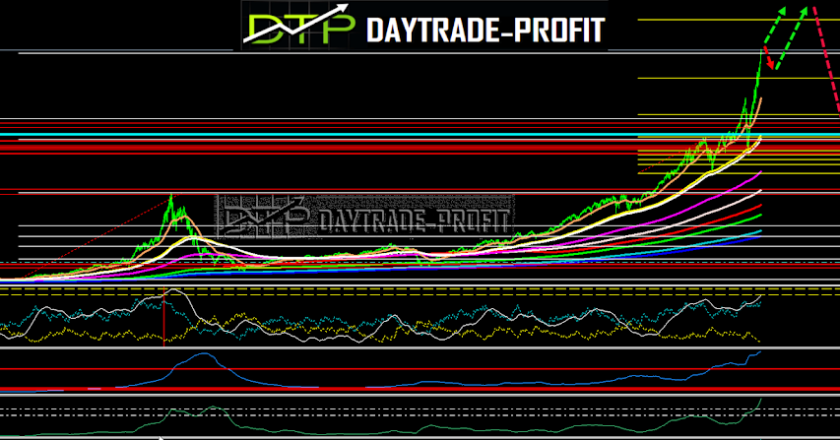

Markets Technical Analysis USA markets are down 9 out of the past weeks, for the third time in its entire history (1970, 1982, 2001) In 2001 it marked the start bear market rally before the bear market continued for nearly another year. Last week after the big sale on Thursday and breaking very important support levels, Friday ended convergence, if…